SC DoR ABL-919 2021-2024 free printable template

Show details

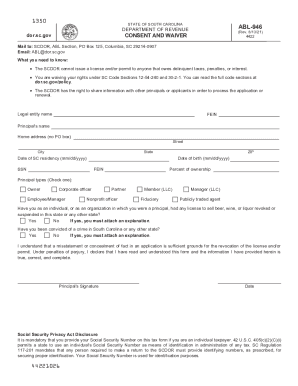

1350STATE OF SOUTH CAROLINAABL919DEPARTMENT OF REVENUEENTITY STRUCTURE SUPPLEMENTAL INFORMATION Former.SC.gov(Rev. 8/16/21) 4378Mail to: SCOR, ABL Section, PO Box 125, Columbia, SC 292140907 Email:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your abl 919 2021-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abl 919 2021-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit abl 919 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit abl 919 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

SC DoR ABL-919 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out abl 919 2021-2024 form

Point by point how to fill out abl 919:

01

Obtain a copy of abl 919 form from the relevant authority or website.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Provide your personal information in the designated fields, such as your name, address, and contact details.

04

Fill out the relevant sections of the form based on your specific situation or purpose for filling out abl 919.

05

Double-check all the information you have provided to ensure accuracy and completeness.

06

Attach any required supporting documents or evidence, if applicable, as mentioned in the instructions.

07

Review the completed form thoroughly to ensure no mistakes or omissions.

08

Sign and date the form in the appropriate section.

09

Submit the filled-out abl 919 form through the designated channels, such as mailing it or submitting it in person.

Who needs abl 919:

01

Individuals who are required by law or regulations to provide specific information or seek approval related to a certain matter.

02

Organizations or businesses that need to comply with regulatory requirements or seek authorization from the relevant authority.

03

People or entities involved in certain activities, such as applying for permits, licenses, or certifications that require the abl 919 form to be filled out.

Fill sc abl 919 form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is abl 919?

Abl 919 does not seem to be a widely recognized term or acronym. It may be a specific code or reference used within a particular context or industry that is not widely known to the general public.

Who is required to file abl 919?

The IRS Form 1099-NEC (formerly known as Form 1099-MISC) is typically filed by businesses and individuals who have made payments for services rendered by non-employees, such as independent contractors, freelancers, or consultants, totaling $600 or more within a tax year.

How to fill out abl 919?

To fill out the ABL 919 form, follow these steps:

1. Begin by entering the date of the report in the provided space at the top of the form.

2. Below the date, provide the name of the debtor in the section labeled "Debtor's Name."

3. In the "Contact Information" section, fill in the debtor's address, including street, city, state, and zip code. Also, provide the debtor's telephone number and email address if available.

4. The next section is "State of Inc.," where you need to provide the state in which the debtor is incorporated or operates. Write the state abbreviation in the provided space.

5. In the "Collateral Indicator" section, select the appropriate box to indicate whether the loan is secured or unsecured.

6. Enter the amount of the loan or credit limit in the space labeled "Loan Amount" or "Credit Limit."

7. In the "Flow Indicator" section, select the appropriate option to indicate the purpose of the report, such as "New Account," "Renewal," "Increase," or "Decrease." Check only one option.

8. If the report is for "Cleanup," meaning the debtor's accounts are being paid off, indicate the "Effective Date" of cleanup in the corresponding space.

9. Complete the "Collateral Description" section by providing a brief description of the collateral, such as machinery, inventory, or accounts receivable.

10. In the "Collateral Value" section, enter the estimated value of the collateral.

11. In the "Borrowing Base (if applicable)" section, provide details about the borrowing base formula, including the ineligible amount and the percentage applied to calculate the eligible amount.

12. The last section, "Comments," provides space to write any additional information or details relevant to the report.

13. Ensure you have reviewed all the information you have provided and verified its accuracy.

14. Sign and date the form in the provided spaces at the bottom.

Remember to consult with your financial institution or lending department in case you require any specific instructions or guidelines regarding the completion of the ABL 919 form.

What is the purpose of abl 919?

ABL 919, or ABL-919, is a small molecule compound developed as a selective antagonist of the P2X7 receptor. The P2X7 receptor is part of a family of ion channels that are involved in the transmission of signals within the central nervous system and immune system. ABL 919 is primarily used as a research tool to study the role of the P2X7 receptor in various physiological and pathological processes. Its purpose is to help scientists gain a better understanding of the receptor's function and potentially identify new therapeutic targets for conditions such as neurodegenerative diseases, chronic pain, and inflammatory disorders.

What information must be reported on abl 919?

ABL 919 is a document used for Asset-Based Lending (ABL) reporting in the financial industry. The specific information that must be reported on ABL 919 may vary depending on the requirements of the lender or regulatory authority. However, some common information that is typically included in the ABL 919 report may include:

1. Borrower Information: This includes the name, legal entity type, and contact details of the borrower.

2. Collateral Valuation and Details: The report may include an assessment of the collateral supporting the loan, such as inventory, accounts receivable, equipment, real estate, etc. This could include the current valuation, type of collateral, location, and other relevant details.

3. Borrowing Base Calculation: ABL loans are often based on a borrowing base formula, which determines the maximum amount that the borrower can borrow. The report should include the calculation methodology, eligibility criteria, and a breakdown of the components comprising the borrowing base.

4. Collateral Aging Analysis: This provides information on the aging of accounts receivable or inventory, which helps assess the quality and liquidity of the collateral. It may include details on the age of receivables, concentration of customers, inventory turnover, etc.

5. Compliance with Financial Covenants: If there are financial covenants associated with the ABL loan, the report may include the borrower's compliance with these covenants. This could involve providing financial statements, ratios, and other relevant information necessary to measure compliance.

6. Loan Repayment Status: The report may include details regarding the borrower's repayment of the loan, including principal and interest payments, and any related fees or charges.

7. Risk Assessment: This section may provide an overall risk analysis of the borrower and collateral. It could include a summary of key risks, mitigants, and recommendations for any necessary actions.

8. Other Relevant Information: Depending on the lender's requirements, any other relevant information that affects the ABL loan may also be included in the report. This could include legal issues, audits, insurance coverage, changes in ownership, etc.

It is essential to note that ABL 919 reports can vary depending on specific regulations, lender requirements, or unique circumstances. Therefore, it is important for both lenders and borrowers to consult the respective guidelines or instructions provided for accurate and comprehensive reporting.

What is the penalty for the late filing of abl 919?

There is not enough information to provide an accurate answer. The penalty for late filing of abl 919 (assuming it refers to a specific form or document) may vary depending on the jurisdiction and the specific regulations in place. It is best to consult the governing body or agency responsible for the form or document in question to determine the exact penalty for late filing.

How can I edit abl 919 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing abl 919 form, you need to install and log in to the app.

How do I fill out the abl form online form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign abl form pdf and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out sc information form on an Android device?

Use the pdfFiller Android app to finish your south carolina abl 919 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your abl 919 2021-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abl Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to abl form

Related to sc abl 919

If you believe that this page should be taken down, please follow our DMCA take down process

here

.